Hong Kong kicked off its flagship blockchain event, FinTech Week 2022, on Monday, announcing a series of policy statements on cryptocurrencies and blockchain as the city attempts to reposition itself as a hub for digital assets and investment.

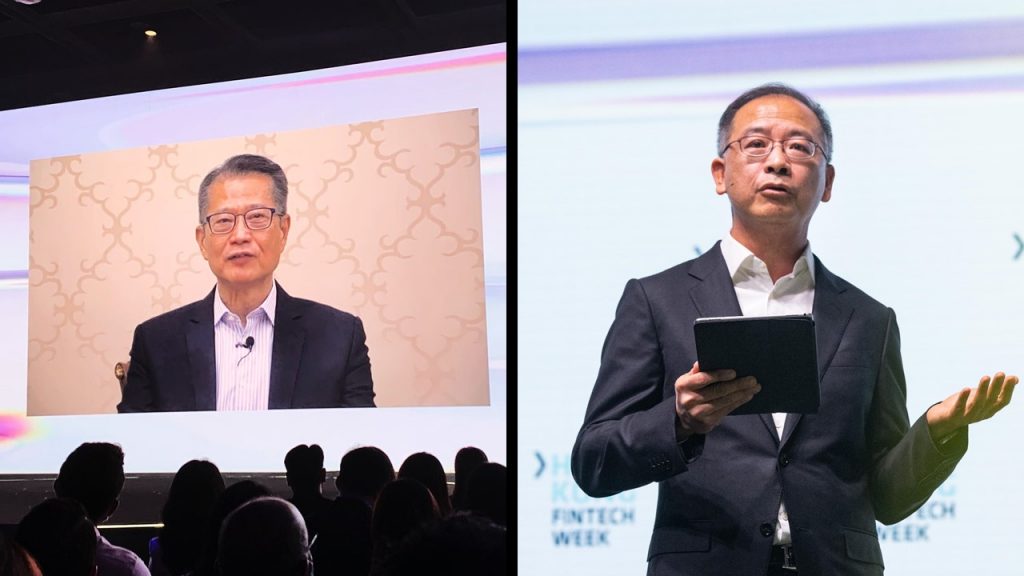

“The digital transformation of our financial services sector is a central priority,” said Hong Kong Financial Secretary Paul Chan in a pre-recorded video statement. Chan was set to speak at the event but is in Covid-19 quarantine in Saudi Arabia and was unable to attend.

Chan said Hong Kong is exploring several pilot projects to test the technological benefits brought by virtual assets and their application in financial markets. These projects involve non-fungible token (NFT) issuance, green bond tokenization, and a digital Hong Kong dollar.

Eddie Yue, the Chief Executive of the Hong Kong Monetary Authority (HKMA), went further in stressing that such innovation should be treated with “radical open-mindedness,” in a speech at the event. “We can use technological innovations to make financial markets more complete and bring benefits for the real world,” he said.

“Blockchain technology also allows fractionalisation of asset ownership in art, real estate or other assets, creating new forms of financial intermediation,” said Yue, while adding that clear, robust regulations have to be part of the agenda.

Shift

The shifts in tone and policy on crypto come as the city’s Hang Seng Index has fallen more than 30% year to date amid a surge in global inflation, rising interest rates, and capital flight from the extended Covid-19 lockdown policies in Hong Kong. The city’s previous tough policies on crypto trading and concern China would extend its crypto ban on the city saw exchanges like FTX, run by billionaire Sam Bankman-Fried, pull out of Hong Kong last year. Some went to rival Singapore.

HKMA is establishing a risk-based and proportionate regulatory regime for payments-related stablecoins, and has issued guidelines to banks about cryptocurrency or decentralized finance (DeFi)-related services, whether account opening or custody services, Yue said.

The Securities and Futures Commission of Hong Kong is also introducing a framework to regulate digital asset trading platforms. The model will follow the basic principles of “same activity, same risk, same regulation,” he said.

“These guardrails will provide a solid foundation and a clear set of rules for Hong Kong to build a vibrant cryptocurrency and DeFi ecosystem,” said Yue.

Development of a central bank digital currency (CBDC) for Hong Kong was highlighted by Chan in his speech.

The HKMA has started preparations to issue Hong Kong’s CBDC and will continue testing with the multi CBDC bridge project mBridge with China and other countries, with the goal of realizing real-time, cross-border foreign exchange, and payment-to-payment transactions.

Hong Kong’s collaboration with the People’s Bank of China also includes testing a digital yuan for cross-border payments in Hong Kong. Yue emphasized the network effects with a CBDC. “The bigger the network, the more users, which in turn will expand the network even further.”

In another policy move on digital assets, Hong Kong’s financial sector regulator, the Securities and Futures Commission, said on Monday the institution plans to allow digital asset-based exchange-traded funds (ETFs) to be publicly listed and traded in the city.

Regulators

Julia Leung, the Commission’s deputy chief executive officer, said at Hong Kong FinTech that the underlying assets of the ETFs will be initially confined to Bitcoin futures and Ether futures traded on the Chicago Mercantile Exchange.

“The SFC has been actively looking to set up a regime to authorize ETFs which provide exposure to mainstream virtual assets with appropriate investor guardrails,” Leung said.

See related article: Hong Kong seeks to allow crypto futures ETFs

In the run up to the Fin-Tech event, officials in Hong Kong prepared the ground for a possible shift on crypto trading, which at present in Hong Kong is limited to so-called professional investors or those with proven assets of HK$8 million, or about US$1 million.

Elizabeth Wong, the director of licensing and head of the fintech unit of the Securities and Futures Commission (SFC), told investors on October 18 that Hong Kong will chart its own course on digital asset policies and not just follow the mainland’s ban on crypto, even invoking the “one country, two systems” under which China governs Hong Kong.

“Hong Kong has one country, two systems principle. It’s a constitutional principle that forms the basic foundation to Hong Kong’s financial markets,” Wong said at a conference to promote investment in Hong Kong.

See related article: Shenzhen leads China in cross-border CBDC transactions: report

“I think it’s also very clear that the language has changed between 2017, 2018, when the official language, not only from the regulator, was a broader cautionary, highlighting risks to investors,” said Donald Day, who formerly worked at the SFC on virtual asset policy, at Crypto Fraud and Asset Recovery Network meeting on Oct.21.

While the capitalization of the cryptocurrency market has fallen 56% in 2022, more financial institutions are showing interest in the asset class.

BlackRock, the world’s largest asset manager with roughly $8.5 trillion under management, said in August it was starting a spot bitcoin trust for institutional clients in the US. British banking giant Barclays invested in cryptocurrency custody firm Copper in July, and Fidelity Investments, one of the largest providers of U.S. 401(k) retirement plans, started allowing customers to invest a portion of their portfolios in bitcoin in April. Fidelity started offering Ethereum trading to institutional investors from Friday.

Bankman-Fried beamed in to the FinTech event, which runs through November 4, and after pulling his exchange HQ out of Hong Kong in 2021 said the city could emerge as Asia’s Web3, blockchain and cryptocurrency hub.

Source by forkast.news